florida estate tax exemption 2020

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is. The 2020 limit after adjusting for inflation is 1158 million.

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

Economic Development Ad Valorem Property Tax Exemption section 1961995 FS PDF 446 KB DR-418C.

. Ad Valorem Tax Exemption Application and. Who has to file a federal estate tax return. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue.

The Gift Tax Exemption is the threshold for the sum of assets that an individual can distribute to another without having such transfer count against their life time gifting. In 2022 an estate generally must file a tax return if it is worth 12060000 or more. The federal government however imposes an estate tax that applies to all United.

So even if you qualify for the federal estate tax exemption An individuals leftover estate tax exemption may be transferred to the surviving. Miami Dade Homestead Exemption Form Fill Online Printable Fillable from. Ad Valorem Tax Exemption.

1 a A person who on January 1 has the legal title or beneficial title in equity to real property in this state and. For estates of decedent nonresidents not citizens of the United States the Estate Tax is a tax on the transfer of US-situated property which may include both tangible and intangible assets. Real Property Dedicated in Perpetuity for Conservation Exemption Application.

Registration Application for Secondhand Dealers andor Secondary Metals Recycler and instructions. The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption. Posted on April 28 2016 December 9 2020.

Federal Estate Taxes. The amount may include both the gross estate as. Florida Estate Tax Exemption 2021.

The homestead tax exemption in florida can result in significant property tax savings. As a result of recent tax law changes only those who die in 2019 with. The 2020 limit after adjusting for inflation is 1158 million.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. 1121 section 1961975 FS PDF 174 KB DR-504W. Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R.

As mentioned Florida does not have a separate inheritance death tax. Estate and Gift Tax Exemptions for 2020. 196031 Exemption of homesteads.

Application for a Consumers Certificate of Exemption. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is. Ad Valorem Tax Exemption Application and Return for Multifamily Project and Affordable Housing Property N.

The Florida state legislature cannot enact a Florida estate tax or inheritance tax that conflicts with the state constitution Florida voters would have to amend the constitution. As of 2016 the following Estate and Gift tax exemptions are in effect. Florida estate tax exemption 2020.

DOC 63 KB PDF 96 KB DR-504CS. We also offer a robust overall tax-planning service for high.

What You Need To Know About Estate Tax In Fl

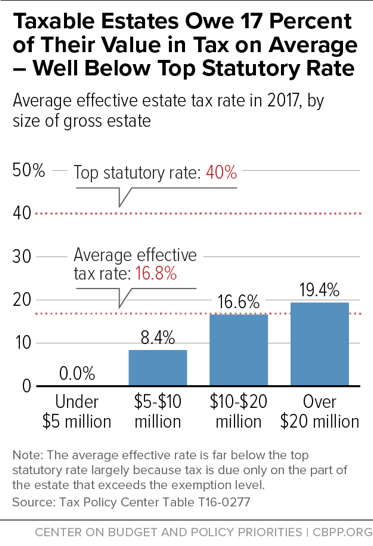

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Florida Estate Planning For Non Citizens Estate Planning Attorney Gibbs Law Fort Myers Fl

2015 Estate Planning Update Helsell Fetterman

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Does Florida Have An Estate Tax

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Desantis Delivers An Estate Tax Savings Gift For Floridians

Estate Tax Exemption For 2023 Kiplinger

Estate Tax In The United States Wikipedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nj Division Of Taxation Inheritance And Estate Tax

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

:max_bytes(150000):strip_icc()/Florida-47fa1160b4c84aec92f9de766d9163ff.jpg)